Table of Contents

Understanding the Investment Required

When it comes to mining cryptocurrency, understanding the costs involved is essential to make informed decisions and ensure a successful venture. As you explore the world of cryptocurrency mining, ResidentialMiner.com is here to guide you through the investment required.

Cryptocurrency mining requires careful consideration of various costs involved. In this article, we will delve into the expenses associated with mining, specifically focusing on ASIC miners, GPUs, and electricity costs. It is important to understand these costs to make informed decisions and optimize your mining operation’s profitability. Additionally, we will discuss the significance of market conditions, such as bull and bear markets, and provide essential advice on avoiding debt while pursuing your mining endeavors.

Equipment Costs

ASIC Miners: Efficiency Comes at a Price

ASIC miners, or Application-Specific Integrated Circuits, are specialized mining devices designed to efficiently mine cryptocurrencies that utilize the proof-of-work (PoW) consensus algorithm, such as Bitcoin and Litecoin. ASIC miners offer high hash rates and energy efficiency, making them a popular choice among professional miners. However, these devices come with a significant price tag. The average price of an ASIC miner can range from a few hundred to several thousand dollars, depending on the model and its mining capabilities. It is important to carefully consider your budget and mining goals when selecting an ASIC miner.

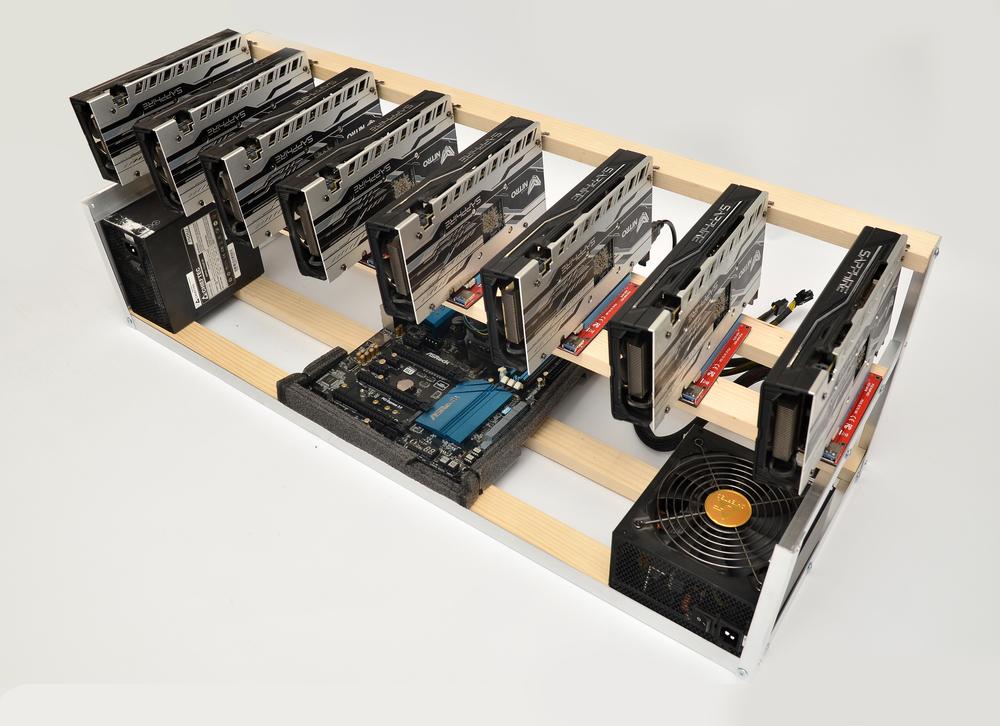

GPUs: Versatile Mining Options

Unlike ASIC miners, which are specific to certain cryptocurrencies, GPUs (Graphics Processing Units) offer versatility in mining different coins. GPUs can mine cryptocurrencies like Ethereum Classic, Ravencoin, and more. Mid-grade GPUs are often favored by individual miners due to their affordability and reasonable mining performance. The average price of a mid-grade GPU can range from a few hundred to around a thousand dollars. When selecting a GPU, it is crucial to consider factors such as power consumption, hash rate, and overall cost-effectiveness.

Other Equipment and Accessories

Apart from the mining hardware itself, there are additional equipment and accessories to consider. Power supply units (PSUs), cooling systems, mining rig frames, and peripherals play crucial roles in setting up and maintaining a mining operation. ResidentialMiner.com offers guidance on selecting the right equipment and accessories to ensure smooth and efficient mining.

Electricity Costs: A Key Consideration

Electricity costs play a significant role in the profitability of cryptocurrency mining. Mining operations consume substantial amounts of electricity, and without careful management, these costs can eat into your earnings. It is important to be mindful of your electricity usage and optimize energy efficiency. Failure to pay attention to electricity costs can lead to reduced profitability or even financial losses. By adopting energy-saving practices, such as using efficient power supplies and exploring renewable energy sources, you can mitigate the impact of electricity expenses on your mining operation.

Mining Pool Fees

Joining a mining pool is a common practice among miners. ResidentialMiner.com provides insights into various mining pools and their fee structures. By choosing the right pool that aligns with your mining goals, you can optimize your chances of mining blocks and earning rewards while managing the associated fees.

Maintenance and Operating Expenses

Running a successful mining operation involves ongoing maintenance and operational expenses. Regular equipment maintenance, hardware upgrades, and stable internet connectivity are crucial for efficient mining. ResidentialMiner.com offers resources and guides to help you minimize downtime and optimize your mining operation’s overall performance.

Other Considerations

Time and Expertise

Starting a mining operation requires time and expertise. It is important to stay informed about the latest trends, algorithms, and software updates in the cryptocurrency mining industry. ResidentialMiner.com provides educational resources to assist you in acquiring the necessary knowledge and skills for successful mining.

Market Volatility

Cryptocurrency prices are highly volatile, and mining profitability is subject to market fluctuations. ResidentialMiner.com encourages miners to stay updated on market trends and diversify their mining portfolio. By adapting to changing market conditions and exploring different coins, you can mitigate risks and enhance your overall profitability.

Market Conditions: Bull vs. Bear Markets

The cryptocurrency market is known for its volatility, characterized by periods of bullish and bearish trends. A bull market refers to a period of rising prices and optimism, while a bear market signifies falling prices and pessimism. Understanding market conditions is crucial when it comes to purchasing mining equipment. In a bear market, hardware prices tend to be more affordable, making it an opportune time to invest in mining equipment. By capitalizing on lower equipment costs during bear markets, you can potentially maximize your return on investment when the market eventually enters a bullish phase.

Debt: A Cautionary Note

While cryptocurrency mining can be a lucrative endeavor, it is essential to exercise financial prudence and avoid going into debt to fund your mining operation. Mining profitability can fluctuate, and unexpected expenses may arise. Taking on debt to purchase mining equipment or cover operational costs can increase financial risk and may lead to difficulties in repaying the borrowed funds. It is advisable to only invest what you can afford to lose and carefully manage your expenses within your means.

Conclusion

Understanding the costs associated with cryptocurrency mining is crucial for making informed decisions and maximizing profitability. ASIC miners and GPUs offer different options with varying price ranges and performance capabilities. Electricity costs should be carefully monitored and optimized to ensure they don’t outweigh your mining rewards. Additionally, considering market conditions and avoiding debt are important factors to protect your financial well-being in the volatile world of cryptocurrency mining.

ResidentialMiner.com is your trusted resource for comprehensive insights into the costs associated with mining. From equipment expenses to electricity costs, maintenance fees, and beyond, being well-informed will empower you to make informed decisions and optimize your mining operation’s profitability. By leveraging the resources and expertise available on ResidentialMiner.com, you can confidently navigate the financial aspects of mining and set yourself up for success.