In the ever-evolving world of cryptocurrency, mining remains a pivotal process, with hardware choice being a crucial decision for enthusiasts and professionals alike. This article delves into the main types of mining hardware: GPU, CPU, ASIC, and Helium miners, highlighting their advantages and disadvantages to help you make an informed choice.

Key Takeaways

- Flexibility of GPU Mining: Ideal for those seeking versatility in mining different cryptocurrencies.

- CPU Mining as a Starting Point: Best for beginners due to its low cost and educational value.

- High Efficiency of ASIC Mining: Offers the highest profitability for specific cryptocurrencies but lacks flexibility.

- Unique Nature of Helium Mining: Environmentally friendly and easy to set up but location-dependent for profitability.

- Consider Your Goals: Choose hardware based on personal objectives, technical knowledge, and available resources.

Comparing Different Types of Mining Hardware

| Feature | GPU Mining | CPU Mining | ASIC Mining | Helium Mining |

|---|---|---|---|---|

| Flexibility | High | Low | Very Low | Low |

| Initial Cost | High | Low | Medium-High | Medium |

| Efficiency | Medium | Low | High | Medium |

| Profitability | Medium-High | Low | High (for specific coins) | Variable |

| Setup Complexity | Medium | Low | Low | Low |

| Energy Consumption | High | Medium | Medium | Low |

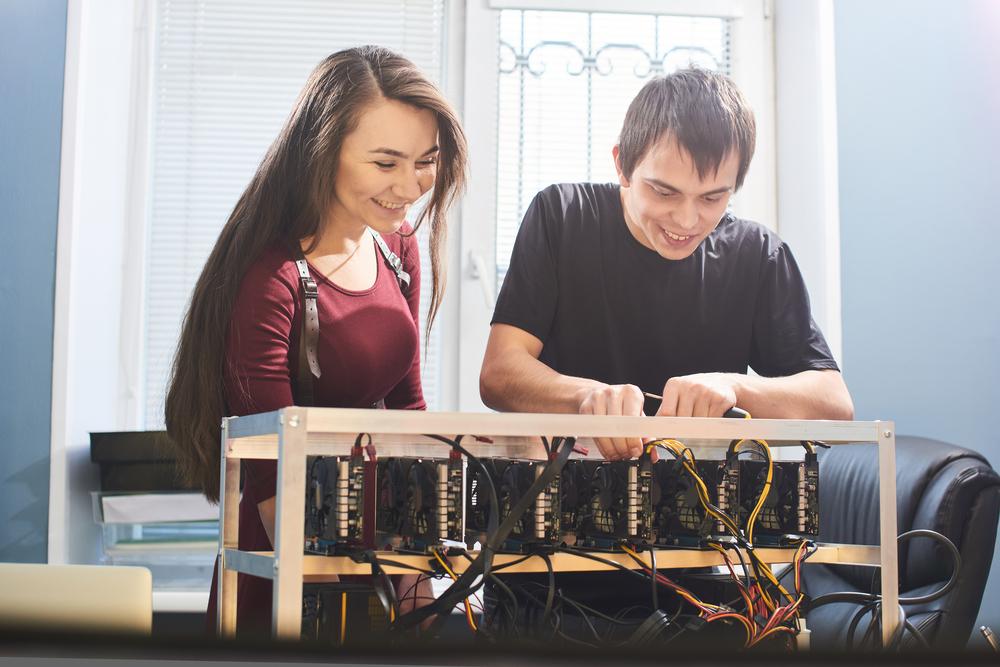

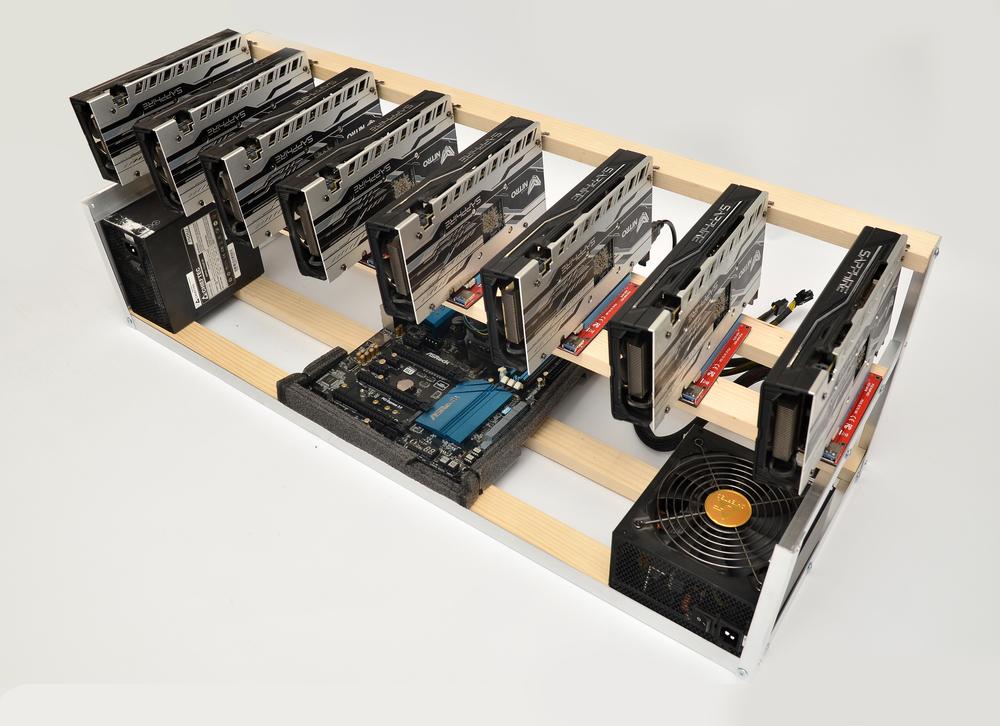

GPU Mining: A Versatile Choice

GPU Mining: A Versatile Choice

GPU mining remains a popular choice due to its flexibility and adaptability. It allows miners to switch between different cryptocurrencies, making it an ideal option for those looking to maximize profits in the ever-changing landscape of the crypto market. Additionally, the resale value of GPUs adds a layer of financial security, as they can be sold to gamers or professionals in graphics-related fields if mining becomes unprofitable.

However, the cost and technical complexity of setting up and maintaining a GPU mining rig can be prohibitive for some. The significant power consumption and cooling requirements also add to the ongoing operational costs, potentially reducing overall profitability. Miners need to stay informed about the latest software and hardware advancements to keep their rigs efficient and competitive.

Pros of GPU Mining

- Flexibility: GPU mining stands out for its ability to mine a variety of cryptocurrencies, making it a versatile option for miners.

- Resale Value: GPUs have a high resale value and can be repurposed for gaming or professional graphic work, offering a safety net for your investment.

- Scalability: You can easily upgrade or expand your GPU mining rig, adapting to changing mining needs.

Cons of GPU Mining

- Cost: The initial setup for a GPU mining rig can be expensive, especially with high-end graphics cards.

- Power Consumption: GPUs consume significant power, impacting electricity bills and reducing overall profitability.

- Cooling Requirements: These rigs require effective cooling solutions to prevent overheating, adding to the setup complexity.

CPU Mining: Accessible but Limited

CPU mining is a great starting point for beginners, offering a low-cost and easily accessible entry into the world of cryptocurrency mining. It allows individuals to utilize existing hardware without the need for significant additional investment. This form of mining is also a great educational tool, providing a hands-on understanding of how blockchain and mining work.

The major drawbacks of CPU mining are its limited profitability and the strain it puts on standard computing hardware. It is less efficient compared to GPU or ASIC mining, leading to lower earnings which may not justify the electricity costs. Additionally, prolonged use of a CPU for mining can lead to increased wear and tear, potentially reducing the lifespan of the computer.

Pros of CPU Mining

- Low Barrier to Entry: CPU mining is accessible, allowing beginners to start mining with existing household computers.

- Minimal Equipment: It requires minimal additional hardware, making it a cost-effective entry point.

Cons of CPU Mining

- Lower Efficiency: CPUs offer lower efficiency and hash rates compared to GPUs and ASICs, translating to lower earnings.

- Limited Profitability: There are fewer cryptocurrencies that are profitable to mine with CPUs, and the earnings are often not worth the electricity costs.

ASIC Mining: High Efficiency, Specific Use

ASIC Mining: High Efficiency, Specific Use

ASIC miners offer unparalleled efficiency and power in mining specific cryptocurrencies. Their design is optimized to excel at computing the algorithms of particular coins, leading to higher profitability in those domains. This specialization, combined with their plug-and-play nature, makes ASICs a popular choice for those looking to maximize earnings from their mining operations.

However, the inflexibility of ASIC miners is a significant limitation. They can only mine certain cryptocurrencies, and a change in the mining algorithm of these coins can render the hardware obsolete. Moreover, the noise and heat production of ASIC miners require a suitable mining environment, which might not be feasible in typical home settings.

Pros of ASIC Mining

- High Efficiency: ASIC miners offer the highest efficiency and hash rates, making them highly profitable for specific cryptocurrencies.

- Compact Setup: These miners are often more compact and require less complex setups than GPU rigs.

Cons of ASIC Mining

- Lack of Flexibility: ASIC miners are designed for specific cryptocurrencies, limiting their use if you wish to switch currencies.

- Obsolescence Risk: They can become obsolete quickly if a cryptocurrency changes its algorithm.

Helium Mining: A Unique Approach

Helium mining offers a distinct approach to cryptocurrency mining, focusing on providing network coverage for IoT devices rather than traditional computational mining. This method consumes far less electricity than other forms of mining, making it an environmentally friendly and cost-effective option. The setup and maintenance of Helium miners are also relatively straightforward, appealing to those who are not technically inclined.

The earnings from Helium mining, however, are highly dependent on the location and density of the Helium network. This can lead to inconsistent and potentially lower profits compared to other mining methods. Additionally, the singular focus on Helium tokens means limited opportunities for diversification in mining different cryptocurrencies.

Pros of Helium Mining

- Low Power Consumption: Helium miners use very little electricity, significantly reducing operational costs.

- Easy Maintenance: These miners are easy to set up and maintain, requiring minimal technical knowledge.

Cons of Helium Mining

- Location Dependent: The profitability of Helium mining is highly dependent on your geographical location and network coverage.

- Limited Earnings: You can only earn Helium tokens, which might limit your potential earnings compared to other mining types.

Making the Right Choice for Your Mining Goals

When choosing the right mining hardware, it’s essential to consider your personal goals, technical expertise, and the resources at your disposal. Factors like budget, space, energy costs, and long-term market trends play a crucial role in determining the most suitable mining approach. It’s also important to think about the scalability and future-proofing of your mining setup, as the cryptocurrency market is known for its volatility and rapid evolution.

Balancing the initial costs with potential long-term profitability is key. Miners should conduct a thorough analysis of the operational expenses, including electricity costs, and the expected return on investment. Staying informed about the latest developments in cryptocurrency mining technology and market trends can also help in making a decision that aligns with both financial objectives and personal interests.

Factors to Consider

- Budget: Consider your initial investment and how it aligns with your mining goals.

- Technical Expertise: Assess your ability and willingness to maintain and troubleshoot your mining setup.

- Long-Term Goals: Think about your long-term objectives, whether it’s generating steady income, experimenting with technology, or contributing to a cryptocurrency network.

Balancing Costs, Efficiency, and Longevity

- It’s crucial to balance the initial costs, operational efficiency, and the potential longevity of your mining hardware. Regularly reviewing market trends and staying informed about technological advancements in mining can help in making the most out of your investment.

Frequently Asked Questions

- What is the most cost-effective mining hardware for beginners?

- CPU mining is often considered the most cost-effective for beginners due to low initial costs.

- Can GPU mining rigs be used for other purposes?

- Yes, GPU mining rigs can be repurposed for gaming, video editing, and other graphic-intensive tasks.

- How do ASIC miners differ from GPUs in terms of flexibility?

- ASIC miners are designed for specific cryptocurrencies, offering little to no flexibility compared to GPUs.

- Is Helium mining profitable in rural areas?

- Profitability in rural areas can be lower due to fewer IoT devices and thus lesser network demand.

- What impacts the profitability of GPU mining?

- Factors include electricity costs, the efficiency of the GPUs, and the market value of mined cryptocurrencies.

- Are there any environmental concerns associated with cryptocurrency mining?

- Yes, concerns include high energy consumption and electronic waste, particularly with inefficient hardware.

Facts & Statistics Section

- GPU Mining: GPUs currently account for approximately 70% of the Ethereum network’s hash rate. [Source: CryptoCompare]

- CPU Mining: Monero (XMR), a popular cryptocurrency for CPU mining, witnessed a 190% increase in hash rate in 2019 following an algorithm update. [Source: Monero Outreach]

- ASIC Mining: The global ASIC miner market size was valued at USD 1.72 billion in 2019 and is projected to grow significantly. [Source: Grand View Research]

- Helium Mining: Over 500,000 Helium hotspots have been deployed worldwide as of 2021, indicating rapid network growth. [Source: Helium]

Conclusion

Choosing the right mining hardware is a balance of cost, efficiency, and long-term goals. Whether you’re a beginner or an experienced miner, understanding the pros and cons of each type can guide you to the best choice for your situation. Feel free to reach out for more tailored advice or to share your mining experiences.