In the world of cryptocurrency mining, analyzing profitability is a crucial aspect for miners to consider. Whether you’re a seasoned miner or just starting out, understanding the factors that affect mining earnings is essential. By delving into the intricacies of mining profitability analysis and learning how to calculate mining revenue, you can make informed decisions and optimize your mining operations. In this comprehensive article, we will explore the key elements that influence mining profitability, providing you with valuable insights to enhance your mining journey.

Factors Affecting Mining Profitability

To gain a deeper understanding of mining profitability, it is important to examine the various factors that play a role in determining earnings. Let’s take a closer look at these factors:

1. Electricity Costs

Electricity costs are a significant consideration for miners, as mining operations consume a substantial amount of power. The cost of electricity varies across different regions, and it can have a major impact on profitability. Miners should carefully evaluate the electricity rates in their area to assess the feasibility of mining. Additionally, exploring renewable energy sources or taking advantage of subsidized electricity can help reduce costs and improve profitability.

2. Cryptocurrency Price and Market Volatility

The price of the cryptocurrency being mined and its market volatility directly influence mining profitability. When the price of a coin increases, miners earn more for their efforts. Conversely, during market downturns, profitability can decrease significantly. Monitoring market trends, understanding the relationship between coin price, market volatility, and mining rewards, and considering potential price fluctuations are essential for miners to make strategic decisions.

3. Mining Algorithm Difficulty

Mining algorithms determine the complexity of mathematical calculations required to mine new blocks. The difficulty of the algorithm affects the time and computational resources needed for successful mining. Higher algorithm difficulty means lower mining rewards unless there is a corresponding increase in the coin’s value. Staying updated with algorithm difficulty adjustments and analyzing their impact on profitability is crucial for miners.

4. Mining Hardware Options

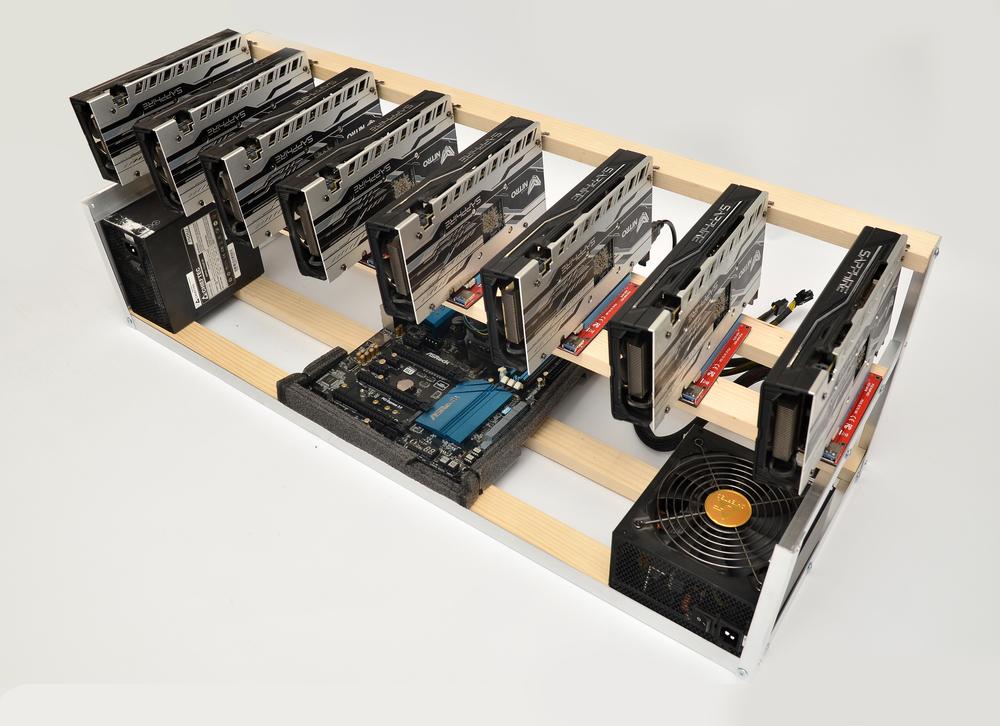

The choice of mining hardware plays a vital role in mining profitability. There are different types of mining hardware available, including GPUs, CPUs, and ASICs. Each type has its own pros and cons in terms of hash rate, energy consumption, and cost. Understanding the strengths and limitations of each hardware option can help miners make informed decisions and optimize their mining operations.

5. Transaction Fees

Apart from block rewards, miners also earn transaction fees associated with the transactions included in the blocks they mine. The transaction fee component can contribute significantly to mining profitability, especially during periods of high network usage. Understanding the dynamics of transaction fees and monitoring their trends can help miners maximize their earnings.

6. Mining Pool Efficiency

Joining a mining pool allows miners to combine their resources and increase their chances of mining new blocks. Mining pools distribute the rewards among participants based on their contribution. It is crucial to select a reliable and efficient mining pool to maximize your earnings. Factors to consider when choosing a mining pool include pool fees, payout mechanisms, and pool reputation.

Calculating Mining Profitability

Calculating mining profitability is essential for miners to determine the viability of mining a particular cryptocurrency. Here are some tips to help you calculate mining profitability:

- Identify the mining hardware you plan to use and gather information on its hash rate, energy consumption, and cost.

- Determine the electricity costs in your area and estimate the power consumption of your mining setup.

- Research the mining difficulty and block rewards of the cryptocurrency you intend to mine.

- Consider the current market price and volatility of the cryptocurrency.

- Factor in transaction fees and any other additional costs, such as maintenance and operational expenses.

By using online mining profitability calculators and considering the factors mentioned above, you can estimate your potential earnings and determine the profitability of your mining venture.

Case Study: Achieving Mining Goals

To provide you with a real-world example of successful mining profitability analysis, let’s explore the case of John, a dedicated miner who set specific goals and achieved them through careful analysis and strategic decision-making.

John began his mining journey by thoroughly researching different cryptocurrencies and analyzing their mining profitability factors. He considered electricity costs, cryptocurrency prices, mining hardware options, and algorithm difficulties. Based on his research, he selected a promising cryptocurrency that aligned with his goals.

Next, John calculated the potential profitability of his mining operation by considering the hash rate and energy consumption of his chosen mining hardware, the current market price, and the anticipated difficulty of the mining algorithm. He factored in transaction fees and accounted for operational expenses.

Throughout his mining journey, John regularly monitored market trends and adjusted his strategies accordingly. When he noticed changes in electricity costs or algorithm difficulties, he recalculated his profitability projections and made necessary adjustments to his mining setup.

By staying motivated and proactive, John successfully navigated the challenges of mining profitability and achieved his goals. His careful analysis and adaptability allowed him to optimize his earnings and overcome potential hurdles.

Conclusion

Analyzing mining profitability is a complex but crucial process for miners. By considering factors such as electricity costs, cryptocurrency prices, mining algorithm difficulties, hardware options, transaction fees, and mining pool efficiency, miners can make informed decisions to maximize their earnings.

Calculating mining profitability using online tools and factoring in various costs and market conditions helps miners determine the viability of their mining ventures. Additionally, learning from real-world case studies, like the example of John, provides valuable insights into achieving mining goals through diligent analysis and strategic decision-making.

Remember, mining profitability is influenced by a multitude of factors, and staying informed, adapting to market conditions, and continuously optimizing your mining setup are key to long-term success.

Disclaimer: This article is for informational purposes only and should not be considered financial or investment advice. Mining cryptocurrencies involves risks, and individual results may vary. It is recommended to conduct thorough research and consult with professionals before engaging in any mining activities.