The ticking clock of Bitcoin’s finite supply has sparked endless speculation and intrigue. With only 21 million coins ever to be mined, the question looms large: what happens when the last Bitcoin emerges from the digital quarry?

This pivotal moment, estimated to occur around 2140, marks not an ending, but a thrilling new chapter in Bitcoin’s story. Understanding the implications of this transition empowers investors, enthusiasts, and the broader cryptocurrency community to prepare for a transformed landscape.

Key Takeaways:

- Bitcoin’s finite supply of 21 million coins sets it apart from other cryptocurrencies, potentially increasing its value over time due to scarcity.

- The last Bitcoin is estimated to be mined around 2140, marking a transition from block rewards to transaction fees for miners.

- This shift might necessitate adaptations like fee structure changes and network security initiatives.

- The post-mining era presents opportunities for Bitcoin to solidify its role as a store of value, global settlement layer, and foundation for future innovations.

- Embracing the unknown and proactively engaging in the Bitcoin community will be crucial to navigate this transition and unlock its full potential.

Comparison Table: Mining Before & After 21 Million

| Feature | Before 21 Million | After 21 Million |

|---|---|---|

| Miner Rewards | Block rewards (currently 6.25 Bitcoin) | Transaction fees |

| Income Source | Primarily block rewards | Entirely transaction fees |

| Focus | Validating transactions & securing the network for block rewards | Validating transactions for transaction fees |

| Network Security | Incentivized by block rewards & potential future advancements | Reliant on a robust fee market and potential protocol innovations |

| Potential Challenges | Managing inflation through halvings | Maintaining network security with solely fee-based system |

| Opportunities | Adapting fee structures and exploring alternative revenue streams | Increased stability and predictability, enhanced security focus, and fostering innovation |

A Scarcity Unlike Any Other: The 21 Million Cap Explained

Imagine a world where gold wasn’t rare, where diamonds littered the streets. Bitcoin’s hard cap of 21 million coins stands in stark contrast to this hypothetical abundance. This deliberate limitation imbues Bitcoin with a crucial trait: scarcity.

Scarcity, a fundamental principle of economics, dictates that when demand outstrips supply, value rises. Compare it to a limited-edition painting – its rarity drives up its price, making it a prized possession.

Bitcoin’s finite supply acts in the same way. As we approach the 21 million mark, the potential for increased value due to this inherent scarcity becomes an increasingly compelling narrative.

Delving into History: A Timeline of Bitcoin Mining

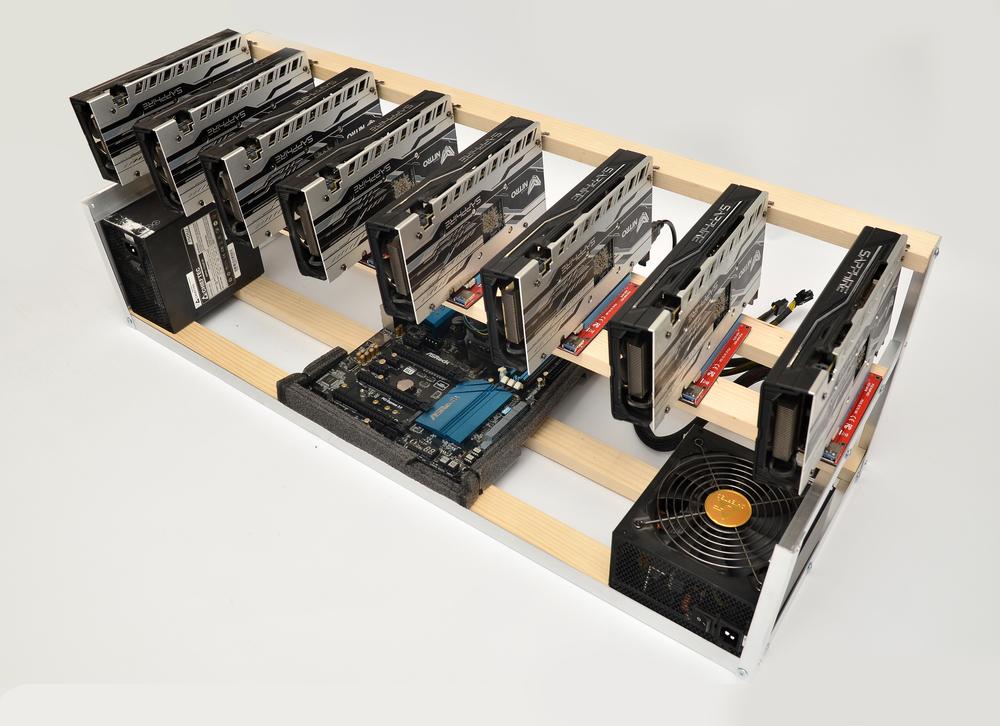

While 2140 might seem like a distant future, Bitcoin’s story began in 2009, marking the genesis of the very first block and the initiation of mining. Back then, miners received a hefty 50 Bitcoin reward for validating transactions and securing the network.

Over time, this reward has undergone a series of halvings, effectively cutting the supply in half every 210,000 blocks mined. This ingenious mechanism serves two important purposes:

Controlling inflation: By gradually reducing the reward, Bitcoin prevents rapid devaluation and maintains its long-term price stability.

Ensuring network security: Miner rewards incentivize participation and maintain the distributed nature of the network, making it resilient against attacks.

Today, as we approach the fourth halving, the block reward stands at 6.25 Bitcoin. As we inch closer to the 21 million cap, the question of miner remuneration shifts from “how much?” to “how will they earn?”.

From Rewards to Fees: The New Frontier of Bitcoin Mining

Once the final Bitcoin is mined, the era of block rewards will come to an end. However, this doesn’t spell doom for miners. Instead, their primary source of income will shift to transaction fees.

Think of it like this: miners act as digital tollbooth operators, verifying transactions and ensuring the smooth flow of information on the Bitcoin network. For this service, they’ll collect a small fee from each transaction processed.

This transition might trigger some initial adjustments:

- Fee structures: As competition for block space heats up, miners might need to adapt their fee models to attract transactions.

- Transaction prioritization: With limited block space, prioritizing higher-fee transactions could emerge to incentivize miners and ensure timely processing.

- Network security: Some worry that relying solely on fees might deter miners, impacting network security. However, a robust fee market, coupled with potential advancements in technology and protocol optimizations, could maintain sufficient incentives for miners to keep the network humming.

- Beyond Mining: Unlocking the Potential of a Scarce Bitcoin

The post-mining era represents an opportunity for Bitcoin to evolve beyond its initial function as a digital currency. With a fixed supply, Bitcoin’s potential as a:

- Store of value: Its inherent scarcity and limited supply could propel Bitcoin into a haven for wealth preservation, similar to gold or other precious metals.

- Global settlement layer: The immutability and security of the Bitcoin network could make it a viable alternative for cross-border transactions, offering faster and cheaper settlements compared to traditional banking systems.

- Foundation for innovation: The Bitcoin protocol can serve as a foundation for countless innovative applications, from decentralized finance (DeFi) to non-fungible tokens (NFTs), further expanding its utility and reach.

- Adapting and Innovating: Embracing the Future of Bitcoin

The shift towards a fee-based mining model demands adaptation from the Bitcoin community. Developers and stakeholders will need to collaborate to address potential challenges and explore new opportunities:

- Protocol enhancements: Optimizing the protocol to be more efficient and less energy-intensive can attract users and miners, creating a sustainable ecosystem.

- Scaling solutions: Finding innovative ways to scale the network without compromising security or decentralization will be crucial to accommodate future growth.

- Community engagement: Open communication and collaboration between developers, miners, and users will be essential to navigate the transition and ensure Bitcoin’s continued success.

The 21 million Bitcoin countdown isn’t a doomsday clock; it’s an invitation to rewrite the future. It’s a chance to witness the evolution of a technological pioneer from a revolutionary currency to a cornerstone of a decentralized, digital future.

Embracing the Unknown: A Positive Outlook on the Post-Mining Landscape

While uncertainties surrounding the post-mining era exist, focusing on the potential benefits paints a compelling picture:

- Greater stability and predictability: With the finite supply, price fluctuations could become less volatile, making Bitcoin a more reliable store of value and a viable option for everyday transactions.

- Enhanced network security: As miners rely on transaction fees for income, they’ll have a vested interest in maintaining the network’s security and efficiency. This could lead to a more robust and resilient system.

- Fueling innovation: The limited supply could incentivize developers to explore alternative revenue models and functionalities for the Bitcoin network, fostering advancements in blockchain technology and its applications.

- Empowering the Individual: Bitcoin Beyond Investment

The post-mining era empowers individuals in several ways:

- Financial inclusion: Bitcoin’s peer-to-peer nature and borderless accessibility empower individuals in financially restrictive environments to participate in the global economy.

- Personal sovereignty: By holding your own Bitcoin, you control your assets without relying on intermediaries like banks or financial institutions.

- Building a fairer world: Bitcoin’s decentralized nature promotes equality and eliminates the risk of manipulation by centralized authorities.

A Call to Action: Preparing for the Bitcoin 2.0

As we approach the 21 million milestone, proactive engagement is crucial to ensure a smooth transition and maximize the potential of Bitcoin’s future:

- Stay informed: Follow trusted news sources and engage in constructive discussions within the Bitcoin community to stay up-to-date on developments and potential challenges.

- Explore beyond trading: Dive deeper into the technical aspects of Bitcoin, understand its underlying protocols, and consider participating in the network through activities like mining or validating transactions.

- Support innovation: Advocate for responsible development and scaling solutions that enhance Bitcoin’s functionality and accessibility while upholding its core principles of decentralization and security.

The 21 million Bitcoin countdown isn’t a final chapter, it’s an exciting prologue.

It’s an invitation to be a part of shaping the future of finance, technology, and even society itself. Embrace the unknown, stay informed, and actively participate in shaping the narrative. The post-mining era holds immense potential, and by working together, we can ensure that Bitcoin’s next chapter is even more groundbreaking than the first.

| # | Coin | Price | Marketcap | Volume (24h) | Supply | Change | Last 24h |

|---|

Facts & Statistics: Unveiling the Numbers Behind Bitcoin’s Scarcity

- Current block reward: 6.25 Bitcoin (as of December 17, 2023)

- Estimated date of last mined Bitcoin: 2140 (subject to change based on mining activity and network adjustments)

- Number of Bitcoin transactions per day: Approximately 300,000 (as of December 17, 2023)

- Percentage of global wealth currently held in Bitcoin: Less than 1%

- Projected global adoption of Bitcoin by 2030: Up to 10% (according to some estimates)

6 FAQs: Demystifying the End of Bitcoin Mining

While predicting future prices is impossible, Bitcoin's scarcity could contribute to increased value due to basic economic principles of supply and demand.

This depends on future transaction fees and network conditions. However, miners might need to adapt their strategies and technology to remain profitable.

Concerns exist, but a robust fee market coupled with potential protocol advancements could incentivize miners to maintain network security.

They can still validate transactions and earn transaction fees. Some might shift focus to other aspects of the Bitcoin ecosystem, like development or node operation.

Greater stability, potentially lower price volatility, and increased adoption as a store of value and global settlement layer.

Stay informed, explore the technical aspects of Bitcoin, engage with the community, and support responsible development to maximize the potential of Bitcoin's future.