Key Takeaways:

- The US crypto market dominates the North American landscape with its $4 trillion valuation, driven by vibrant trading, diverse assets, and institutional investment.

- Canada, with a $250 billion market, showcases impressive growth fueled by a tech-savvy population and a supportive regulatory framework.

- Both markets offer a range of assets, including established currencies like Bitcoin and Ethereum, but the US market boasts a greater diversity of altcoins, tokens, and NFTs.

- The US regulatory landscape remains complex and uncertain, while Canada has adopted a clearer and more supportive approach, fostering innovation and attracting global investment.

- US investors have greater control over their assets but face higher risks and complexities, while Canadian investors have access to both custodial and non-custodial solutions.

- Tax implications for crypto transactions differ between the two countries, requiring investors to consult tax professionals for compliance.

Comparison Table: US vs. Canada Crypto Market

| Feature | US Crypto Market | Canadian Crypto Market |

|---|---|---|

| Market Size | $4 trillion | $250 billion |

| Growth Rate | High | High |

| Regulatory Landscape | Complex and evolving | Clear and supportive |

| Assets Traded | Wide variety: Bitcoin, Ethereum, altcoins, tokens, NFTs, derivatives | Primarily Bitcoin and Ethereum, with growing interest in DeFi and security tokens |

| Ownership and Issuance | Decentralized, favoring individual control | Offers both custodial and non-custodial solutions |

| Trading Dynamics | 24/7 | Limited hours, influenced by traditional financial markets |

| Tax Implications | Crypto treated as property for tax purposes | Crypto generally treated as commodities for tax purposes |

Market Size and Growth:

The United States reigns supreme in terms of market size, boasting an estimated value exceeding $4 trillion. This dominance stems from factors like a vibrant trading environment, diverse asset offerings, and significant institutional investment. Canada, while smaller with an estimated value of $250 billion, showcases impressive growth fueled by a tech-savvy population and a supportive regulatory framework.

Regulatory Landscape:

The US regulatory landscape remains complex and evolving. While the SEC and CFTC play major roles in overseeing the market, the lack of a comprehensive regulatory framework can lead to uncertainty for investors and businesses. In contrast, Canada has established a clearer and more supportive regulatory environment. The Canadian Securities Administrators (CSA) have implemented regulations tailored specifically for crypto assets, fostering innovation and attracting global investment.

Assets Traded:

The US market offers a vast and diverse array of crypto assets, encompassing established currencies like Bitcoin and Ethereum, a plethora of altcoins, tokens, stablecoins, derivatives, and a thriving NFT space. This diversity provides investors with a broad range of options and potential investment strategies. Canada, while primarily focused on well-established currencies like Bitcoin and Ethereum, has also seen increasing interest in DeFi projects and security tokens.

Ownership and Issuance:

The US leans towards decentralized approaches, empowering individuals with greater control over their assets. However, this freedom can also increase risk and complexity. Canada, on the other hand, fosters a more balanced environment by facilitating both custodial and non-custodial solutions, offering a choice between individual control and secure storage. Additionally, Canada’s clear regulatory framework provides a smoother path for asset issuance, attracting established and innovative projects.

Trading Dynamics:

The US market operates on a 24/7 basis, offering continuous trading and potentially greater liquidity. This can be advantageous for active traders seeking to capitalize on market movements. However, Canada’s limited trading hours, influenced by traditional financial markets, promote a more predictable and less volatile environment, potentially better suited for long-term investors.

Tax Implications:

Understanding the tax implications of cryptocurrency transactions is essential for both US and Canadian investors. In the US, cryptocurrencies are treated as property for tax purposes, resulting in capital gains or losses depending on the nature of the transaction. Canada, on the other hand, generally treats cryptocurrencies as commodities for tax purposes, leading to different tax considerations. Consulting with a tax professional is crucial for ensuring compliance and minimizing tax burdens.

Impact of recent events:

The recent collapse of major crypto exchanges like FTX has significantly impacted the overall crypto market, prompting increased scrutiny and regulatory pressure. While the US market has been more affected, Canada has also experienced repercussions, particularly with the withdrawal of Binance from the Canadian market. These events highlight the need for robust regulatory frameworks and investor vigilance.

Looking ahead:

Both the US and Canadian crypto markets are poised for continued growth and innovation. The US is expected to experience further institutional adoption and potential regulatory clarity, while Canada is likely to remain a hub for DeFi and blockchain technology development. As these markets evolve, staying informed and adapting strategies will be crucial for investors and businesses to navigate the ever-changing landscape.

ResidentialMiner.com: Your Trusted Guide in the Crypto Landscape

Whether you’re a seasoned investor or just starting out, navigating the intricate world of cryptocurrency can be daunting. ResidentialMiner.com is your one-stop resource for comprehensive guides, market analysis, expert insights, and valuable tools to empower you throughout your crypto journey.

From choosing the right mining hardware to understanding complex tax implications, ResidentialMiner.com provides the knowledge and support you need to make informed decisions and maximize your success in the US and Canadian crypto markets.

Join the Conversation:

Share your insights and experiences related to the US and Canadian crypto markets in the comments below! Let’s navigate this exciting frontier together and unlock the full potential of cryptocurrency.

Facts & Statistics:

- The global crypto market is predicted to reach $11.8 billion by 2027. (Source: https://www.statista.com/)

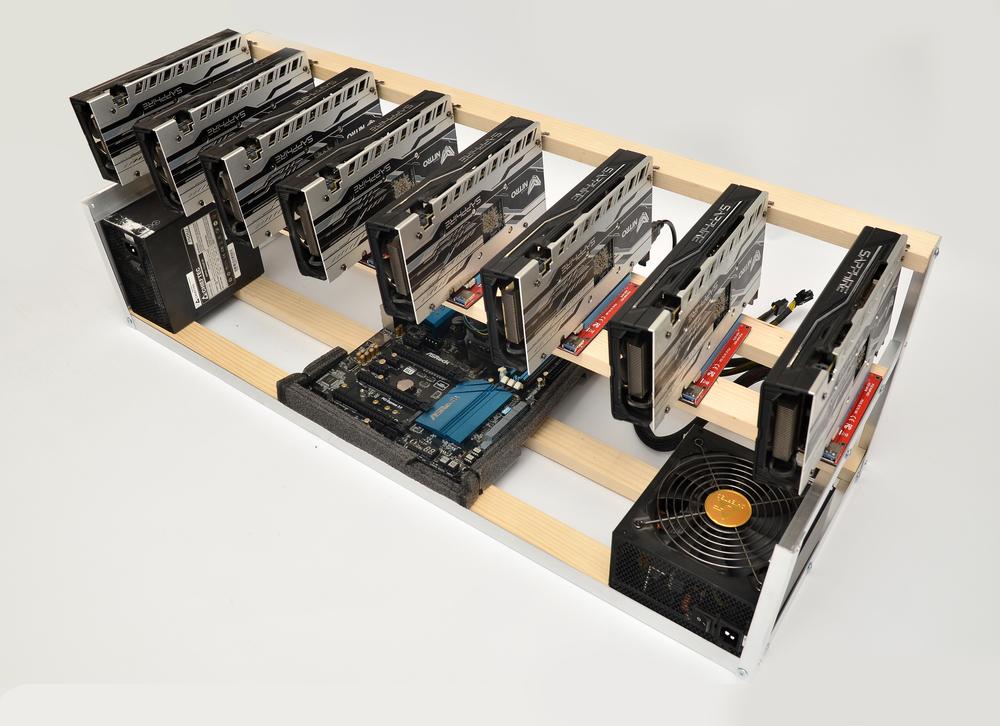

- The energy consumption of crypto mining is a growing concern, but initiatives like renewable energy adoption and energy-efficient mining technologies are being implemented to mitigate this impact. (Source: https://ccaf.io/cbnsi/cbeci/ghg)

- The use of blockchain technology in various sectors, such as finance, supply chain management, and healthcare, is expected to further drive the growth of the crypto market. (Source: https://www.grandviewresearch.com/press-release/global-blockchain-technology-market)

FAQs

Which country has a more favorable crypto market for investors?

There’s no definitive answer as it depends on individual needs and risk tolerance. The US market offers greater diversity and potential returns, while the Canadian market provides a more predictable and regulated environment.

What are the biggest challenges facing the US and Canadian crypto markets?

Both markets face challenges in terms of regulatory uncertainty, market volatility, and investor protection. Additionally, the recent collapse of major crypto exchanges has significantly impacted the overall market, highlighting the need for robust regulatory frameworks.

How can I stay informed about the latest developments in the US and Canadian crypto markets?

To stay informed about the latest developments in the U.S. and Canadian crypto markets, consider following specific YouTube channels known for their expertise in crypto mining:

Red Panda Mining: Based in Canada, this channel provides insights into cryptocurrency mining, focusing on GPU and ASIC mining rigs. They often cover the latest mining hardware and techniques, which can be useful for residential miners.

Mining Chamber: Another Canadian-based channel, Mining Chamber offers tutorials, rig build guides, and reviews on mining hardware. Their content can help you optimize your home mining setup.

Rabid Mining: Also from Canada, Rabid Mining provides content on crypto mining, including updates on mining profitability and energy efficiency, crucial for residential miners looking to maximize returns.

In addition to these resources, it's beneficial to regularly visit ResidentialMiner.com. By subscribing to the ResidentialMiner.com newsletter, you can receive comprehensive market analysis, expert insights, and updates on regulatory changes and emerging trends. This will keep you well-informed and help in making strategic decisions for your mining operations.

For those interested in a more structured learning approach, SonOfATech offers a Crypto Mining Course at sonofatech.com. This course can provide you with in-depth knowledge and practical skills for optimizing your residential mining activities. Remember, continuous learning and staying updated with reliable sources are key to successful crypto mining at home.

What are the potential future trends for the US and Canadian crypto markets?

Both markets are expected to experience continued growth and innovation. The US market is likely to see further institutional adoption and potential regulatory clarity, while Canada is poised to remain a hub for DeFi and blockchain technology development.

Where can I learn more about mining cryptocurrency?

ResidentialMiner.com offers a wealth of resources and guides on mining hardware, software, profitability analysis, and best practices.

How can I participate in the US and Canadian crypto markets?

There are various ways to participate, from buying and selling cryptocurrencies on exchanges to investing in DeFi projects and mining your own digital assets. The best approach depends on your individual goals and risk appetite.