Cryptocurrency has revolutionized the financial world, offering investors new opportunities for wealth creation. Traditional investment strategies have long been used to navigate the complexities of financial markets and achieve consistent returns. With the rise of cryptocurrency mining, it becomes crucial to explore how traditional investment strategies can be applied to this emerging sector. In this article, we will delve into the various ways you can apply traditional investment strategies to mining cryptocurrency successfully.

Understanding Traditional Investment Strategies

To effectively apply traditional investment strategies to mining cryptocurrency, it’s important to have a solid understanding of these strategies. Traditional investment strategies typically involve diversification, risk management, and long-term planning. By adopting these strategies, investors aim to maximize returns while minimizing potential risks.

Diversification: The Key to Mitigating Risks

Diversification is a fundamental principle in traditional investing that helps spread investment risks. The same principle can be applied to mining cryptocurrency. Instead of solely focusing on one type of cryptocurrency, it is advisable to diversify your portfolio by investing in multiple cryptocurrencies. This approach ensures that if one cryptocurrency underperforms, the others may compensate for the losses.

Risk Management: Protecting Your Investments

Risk management plays a crucial role in traditional investing and is equally important in mining cryptocurrency. Volatility is a characteristic of the cryptocurrency market, and it’s essential to implement risk management strategies to protect your investments. Setting stop-loss orders, using trailing stops, and conducting thorough research before investing are some effective ways to manage risks associated with cryptocurrency mining.

Applying Traditional Investment Strategies to Mining Cryptocurrency

Researching and Analyzing Cryptocurrencies

When applying traditional investment strategies to mining cryptocurrency, it’s crucial to research and analyze different cryptocurrencies just as you would with stocks. Conduct comprehensive research on various cryptocurrencies, including their underlying technology, market trends, and potential risks. By doing so, you can make informed investment decisions and identify lucrative mining opportunities.

For example, let’s consider Bitcoin (BTC), Cardano (ADA), and Polkadot (DOT). Researching these cryptocurrencies would involve studying their technology, market demand, and potential for growth. However, it’s important to note that as of the Ethereum merge that occurred on September 15th, 2022, Ethereum (ETH) has transitioned to a proof-of-stake consensus mechanism, and mining Ethereum is no longer possible.

Long-Term Investing for Steady Returns

Traditional investment strategies often emphasize long-term investing for steady returns, and this approach can be applied to other cryptocurrencies. Instead of focusing solely on short-term gains, consider investing in promising cryptocurrencies with strong fundamentals and long-term growth potential.

For instance, cryptocurrencies like Cardano (ADA), Ripple (XRP), and Polkadot (DOT) have shown promising long-term potential. Cardano aims to provide a secure and scalable platform for the development of decentralized applications. Ripple seeks to revolutionize cross-border payments, while Polkadot offers interoperability between different blockchains. By adopting a long-term investment approach, you can potentially benefit from the growth and development of these cryptocurrencies over time.

Dollar-Cost Averaging: Mitigating Market Volatility

Dollar-cost averaging, a proven strategy in traditional investing, can be applied to cryptocurrencies other than Ethereum. By regularly investing a fixed amount of money, regardless of market conditions, you can mitigate the impact of market volatility on your investments.

For example, let’s say you decide to invest $500 every month in Bitcoin (BTC) and Cardano (ADA). If the price of Bitcoin or Cardano is high, you would receive fewer units for your $500 investment. Conversely, when the price is low, you would receive more units. Over time, this strategy helps smooth out the effects of market volatility and potentially lowers your average cost per unit.

Setting Realistic Goals and Sticking to Them

Goal-setting is an integral part of any investment strategy, even if mining Ethereum is no longer possible. Define realistic goals for your cryptocurrency investments and establish a clear roadmap to achieve them. Whether your objective is to accumulate a specific amount of a certain cryptocurrency or generate passive income, setting goals provides direction and helps you stay focused during market fluctuations.

For example, your goal could be to accumulate a certain number of Bitcoin or invest a specific amount of money in a particular cryptocurrency within a given timeframe. This goal provides a specific target and allows you to plan your investments accordingly. Regularly review your progress and adjust your strategy if needed to stay on track.

Keeping Emotions in Check

Emotional decision-making can be detrimental to investment success, even when mining Ethereum is no longer an option. It’s important to keep emotions in check and avoid making impulsive decisions based on short-term market fluctuations. Instead, rely on your research, analysis, and adherence to your long-term investment strategy to make informed decisions that align with your goals.

For instance, during periods of market volatility where cryptocurrency prices are experiencing significant fluctuations, it’s essential to resist the temptation to panic sell or buy impulsively. By staying focused on your long-term investment strategy and considering the fundamental value of the cryptocurrencies you invest in, you can make more rational decisions that are not drivenby temporary market fluctuations. This approach allows you to stay aligned with your long-term goals and objectives.

FAQs

How do I choose the right cryptocurrency to mine?

Choosing the right cryptocurrency to mine requires careful consideration. Factors to evaluate include the cryptocurrency’s market potential, technological innovation, team behind the project, and community support. Conduct thorough research and analysis to identify cryptocurrencies with strong fundamentals and long-term growth prospects.

Is cryptocurrency mining profitable?

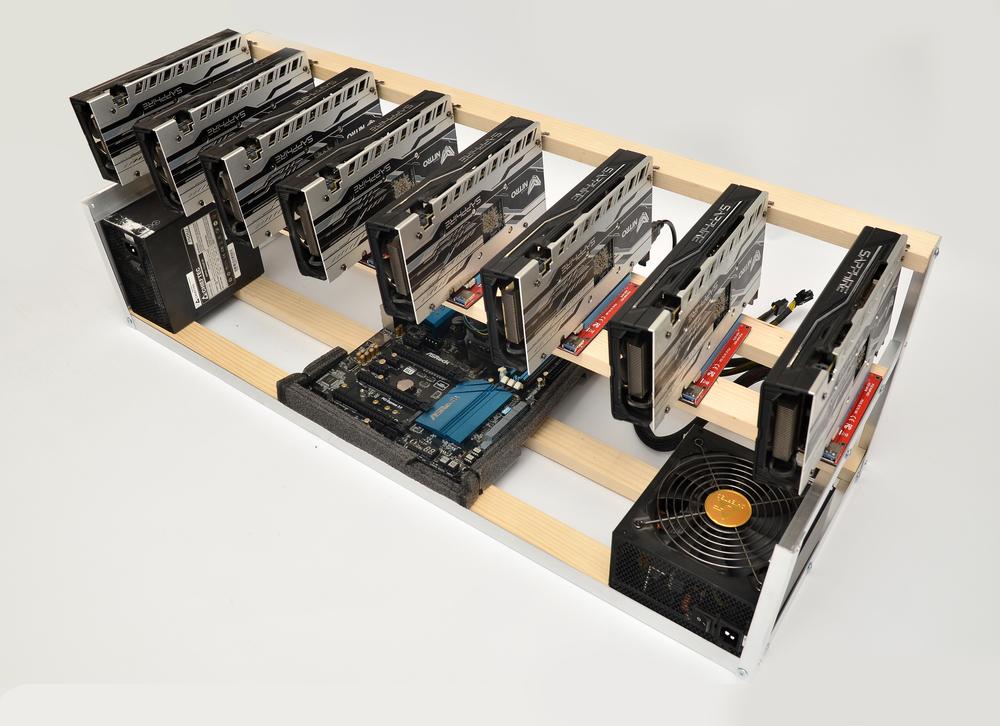

Cryptocurrency mining can be profitable, but it depends on various factors such as the cost of electricity, mining hardware, cryptocurrency prices, and mining difficulty. It’s essential to calculate the potential costs and expected returns before engaging in mining activities.

What are the risks involved in mining cryptocurrency?

Mining cryptocurrency carries certain risks, including market volatility, technological advancements that may render certain cryptocurrencies obsolete, regulatory changes, and the emergence of more efficient mining methods. It’s crucial to stay updated on industry trends and employ risk management strategies to mitigate these risks.

Should I mine cryptocurrency independently or join a mining pool?

Both options have their pros and cons. Mining independently allows you to keep the entire mining rewards but requires significant investment in hardware and infrastructure. Joining a mining pool allows for more consistent returns but involves sharing rewards with other participants. Consider your resources, technical expertise, and risk tolerance when deciding which approach to take.

What is cloud mining, and is it a viable option?

Cloud mining involves renting mining power from a third-party provider. It can be a convenient option for individuals without the necessary technical skills or resources to set up and maintain mining hardware. However, it’s crucial to research and select reputable cloud mining providers as there have been instances of fraudulent schemes in the industry.

How can I ensure the security of my mined cryptocurrencies?

To ensure the security of your mined cryptocurrencies, employ robust security practices. Use reputable wallets to store your cryptocurrencies, enable two-factor authentication, and regularly update your software. Additionally, consider offline storage options like hardware wallets for enhanced security.

Conclusion

Applying traditional investment strategies to cryptocurrencies requires thorough research, a long-term perspective, and disciplined decision-making. While mining Ethereum is no longer possible after the successful Ethereum merge in September 2022, there are still numerous cryptocurrencies available for investment and potential mining opportunities. By researching and analyzing cryptocurrencies, adopting a long-term investment approach, practicing dollar-cost averaging, setting realistic goals, and keeping emotions in check, you can navigate the cryptocurrency market with greater confidence and increase your chances of success.