Understanding Proof of Stake (PoS)

Proof of Stake is a consensus mechanism where validators are chosen to create new blocks and secure the network based on their ownership or “stake” in the cryptocurrency. In PoS, miners are not required to solve complex mathematical puzzles like in PoW. Instead, they are selected to validate transactions and create new blocks based on the number of coins they hold and are willing to “stake” or lock up as collateral. PoS offers several advantages, including lower energy consumption, faster block confirmation times, and reduced reliance on expensive mining hardware. Validators are incentivized to act honestly, as they can lose their staked coins if they engage in malicious behavior.Understanding Proof of Work (PoW)

Proof of Work is the original consensus mechanism introduced by Bitcoin. In PoW, miners compete to solve complex mathematical puzzles to validate transactions and create new blocks. This process requires substantial computational power and energy consumption. Miners who successfully solve the puzzle first are rewarded with cryptocurrency. PoW has been widely adopted and proven to be secure. It ensures that the network remains decentralized by requiring miners to invest in expensive hardware and compete fairly for block rewards. However, PoW is criticized for its energy-intensive nature and potential for centralization due to the concentration of mining power in the hands of a few large mining operations.Security and Decentralization

Both PoS and PoW aim to ensure the security and decentralization of the cryptocurrency network. However, they achieve this in different ways.- PoS: PoS provides security through the economic incentives of validators. Validators are motivated to act honestly because they have a financial stake in the network. However, if a malicious validator acquires a majority of the staked coins, they can potentially manipulate the network, although this is economically impractical.

- PoW: PoW achieves security through the computational work required to solve puzzles. Miners must invest in hardware and compete to solve puzzles, making it difficult for any single entity to control the network. However, PoW is susceptible to a 51% attack, where an attacker with a majority of the network’s computational power can potentially manipulate the blockchain.

Energy Efficiency

Energy efficiency is a significant consideration for miners, as electricity costs can impact profitability and sustainability.- PoS: PoS is generally considered more energy-efficient than PoW since it does not require intense computational work. Validators participate in block creation based on their staked coins, reducing the energy consumption associated with mining.

- PoW: PoW mining can be energy-intensive due to the computational power required to solve mathematical puzzles. As a result, PoW has faced criticism for its environmental impact and energy consumption.

Scalability

Scalability refers to a consensus mechanism’s ability to handle increasing transaction volumes and network growth.- PoS: PoS has the potential to be more scalable than PoW. With PoS, block creation and transaction validation can be faster and more efficient, enabling higher transaction throughput.

- PoW: PoW has faced challenges with scalability, as the increasing computational requirements and block sizes can lead to longer confirmation times and higher transaction fees during periods of high network demand.

Accessibility and Entry Barriers

Accessibility and entry barriers determine how easily individuals can participate in the consensus mechanism and become miners.- PoS: PoS typically has lower entry barriers compared to PoW. Validators can participate in block creation and securing the network by staking their coins. The requirement to hold a certain amount of cryptocurrency may still pose a barrier for some individuals.

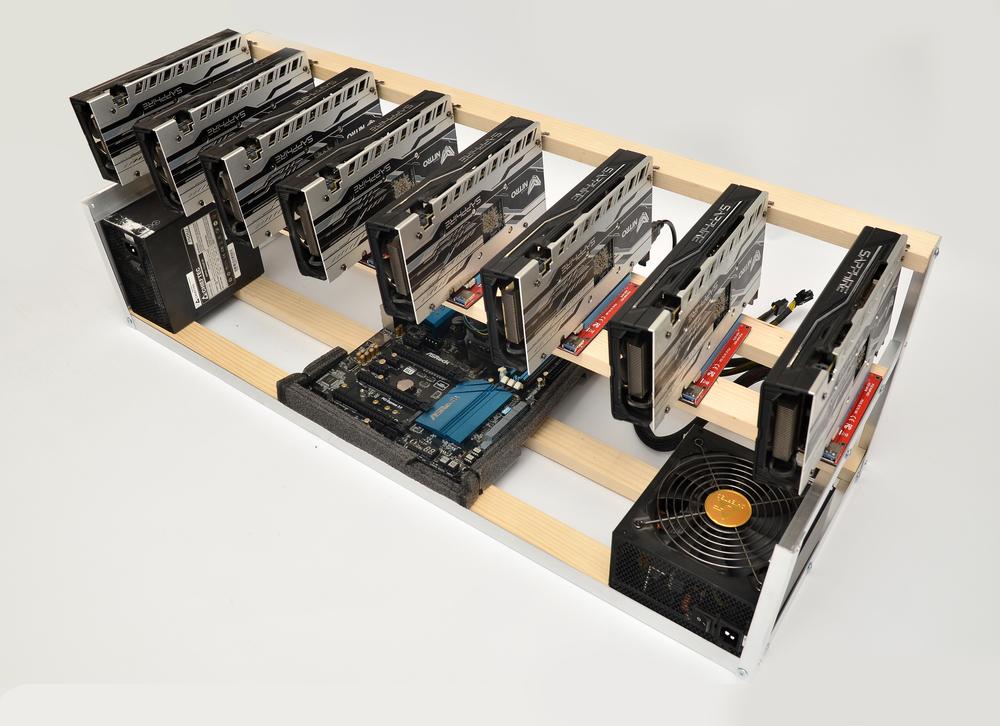

- PoW: PoW often requires significant investments in specialized mining hardware, which can be expensive. The need for powerful hardware creates a barrier to entry for newcomers.

Finality and Consensus Speed

Finality refers to the irreversibility of confirmed transactions and the speed at which consensus is reached.- PoS: PoS can achieve faster finality and consensus compared to PoW. Since validators are chosen based on their stake, block confirmation times can be shorter, providing faster transaction settlements.

- PoW: PoW requires a certain number of confirmations to achieve a high level of finality. This can result in longer confirmation times, especially for transactions with lower fees.

Economic Considerations

Economic considerations play a crucial role in determining the profitability and incentives for miners.- PoS: In PoS, validators earn rewards in proportion to their stake in the network. The more coins they hold and stake, the more rewards they receive. Validators may also face penalties, such as losing their staked coins for malicious behavior.

- PoW: In PoW, miners compete to solve puzzles and are rewarded with cryptocurrency. The mining rewards diminish over time, and miners must consider factors such as electricity costs, hardware depreciation, and network difficulty when determining profitability.

Hybrid Approaches

Some cryptocurrencies and blockchain networks combine elements of both PoS and PoW in hybrid consensus mechanisms. These hybrid approaches aim to leverage the advantages of both PoS and PoW while mitigating their respective disadvantages. Hybrid consensus mechanisms can offer improved security, scalability, and energy efficiency.Choosing the Right Consensus Mechanism

When choosing the right consensus mechanism, consider the following factors:- Energy cost and sustainability goals

- Hardware and infrastructure requirements

- Network decentralization and security concerns

- Transaction throughput and confirmation times

- Accessibility and entry barriers

- Economic incentives and profitability considerations

Proof of Stake vs. Proof of Work Frequently Asked Questions (FAQs)

Both PoS and PoW aim to ensure network security. PoS relies on economic incentives, while PoW relies on computational work. Each has its own strengths and vulnerabilities.

The ability to switch consensus mechanisms depends on the specific cryptocurrency and blockchain network. It may require a hard fork or a migration process.

Yes, several cryptocurrencies use hybrid consensus mechanisms that combine elements of PoS and PoW to achieve desired characteristics.

PoS is generally considered more energy-efficient and environmentally friendly compared to PoW due to its lower energy consumption.

PoS does not require specialized mining hardware like PoW. Validators can participate with a regular computer or even a smartphone.

Yes, some blockchain networks utilize both PoW and PoS. PoW may be used for block creation, while PoS may be used for block validation.

Conclusion

Choosing the right consensus mechanism, whether it’s PoS, PoW, or a hybrid approach, is a crucial decision for ResidentialMiner.com. Consider factors such as energy efficiency, security, scalability, accessibility, and economic incentives when making your choice. Keep in mind that consensus mechanisms can vary between cryptocurrencies, so it’s important to evaluate each cryptocurrency’s specific characteristics. By understanding the differences between PoS and PoW, you can make an informed decision that aligns with your mining objectives.

2 Comments