Cryptocurrency mining has evolved into a lucrative venture, attracting newcomers seeking to join the digital gold rush. However, with the multitude of options available, making an informed decision on which cryptocurrency to mine can be challenging. We present a detailed road map or decision matrix to guide you through this intricate process. This comprehensive guide will help you make informed choices based on your goals, equipment, and market trends. So, let’s embark on this journey of exploration and discovery as we navigate through the essential factors that contribute to choosing the right cryptocurrency to mine.

1. Define Your Goals

Mining for cryptocurrencies is a nuanced endeavor that demands clarity in your objectives. Are you aiming for short-term profits or looking to accumulate assets over the long run? Determining this will influence the type of cryptocurrencies you should consider. Furthermore, you need to clarify whether you’re interested in stablecoins, known for their consistent value, or altcoins with the potential for substantial growth. Your goals serve as the foundation for the rest of your decision-making process.

Consider the following points:

- Are you aiming for short-term profits or looking to accumulate assets over the long run?

- How much risk are you willing to take to pursue your goals?

- Do you prefer stablecoins, known for their consistent value, or altcoins with the potential for substantial growth?

Determining your goals will lay the foundation for the rest of your decision-making process and guide your choices in the coming steps.

2. Research Coin Profiles

Studying the whitepapers and technical documentation of potential coins is a crucial step. These documents provide insights into each coin’s underlying technology, use cases, and problem-solving approaches. Analyzing the use cases helps you understand the real-world applications of cryptocurrency and its relevance in the market. Additionally, examining the problem-solving approach showcases the innovation and uniqueness of the coin. Understanding the target audience of each coin is equally important, as it helps you align your mining efforts with the preferences and needs of potential users.

Dive into the details and consider the following aspects:

- Whitepapers and Technical Documentation: Thoroughly review the whitepapers and technical documentation of potential coins. These documents provide insights into the underlying technology and mechanics of each cryptocurrency.

- Use Cases and Problem-Solving: Analyze the use cases and problem-solving approaches outlined in the whitepapers. Understanding the practical applications of the cryptocurrency can give you a clearer picture of its relevance in the market.

- Innovation and Uniqueness: Examine the problem-solving approach presented by each coin. Highlight any innovative features or unique selling points that differentiate the cryptocurrency from others.

- Target Audience: Understand the target audience of each coin. This knowledge can help you align your mining efforts with the preferences and needs of potential users, increasing the chances of success.

By delving deep into these profiles, you’ll gain a comprehensive understanding of the potential of each cryptocurrency, allowing you to make a more informed decision about which one to mine.

3. Network Security and Hashrate

The security of a cryptocurrency network is paramount. Assess the network’s hashrate and security mechanisms, such as Proof-of-Work (PoW) or Proof-of-Stake (PoS). Choosing coins with a decentralized mining ecosystem is essential to avoid centralization risks. Centralization can lead to control being concentrated in the hands of a few entities, potentially undermining the integrity and decentralization of the network. Prioritizing coins with strong security features ensures the stability and longevity of your mining efforts.

When evaluating different coins to mine, consider the following factors related to network security and hashrate:

- Hashrate Assessment: Assess the network’s hashrate, representing the computing power to secure the blockchain. A higher hashrate indicates a more secure network that is less susceptible to attacks.

- Security Mechanisms: Understand the security mechanisms employed by the cryptocurrency network. These can include Proof-of-Work (PoW) or Proof-of-Stake (PoS). PoW requires miners to solve complex mathematical puzzles to validate transactions, while PoS involves validators who are chosen based on the number of coins they hold.

- Decentralization Importance: Prioritize coins with a decentralized mining ecosystem. Centralization risks can arise when control over mining is concentrated in the hands of a few entities. Decentralization enhances the network’s integrity and prevents the concentration of power.

By choosing coins with strong security features and a decentralized mining structure, you contribute to the stability and long-term success of your mining endeavors.

4. Market Demand and Liquidity

Evaluating the demand for a cryptocurrency in the market is pivotal. Research its adoption rate, user base, and potential for wider acceptance. Check the trading volume and liquidity on reputable exchanges to gauge the ease of buying and selling the coin. High liquidity enables you to quickly convert mined coins into other assets or currencies. A cryptocurrency with substantial market demand and liquidity is more likely to provide a profitable mining experience.

Consider the following aspects when assessing market demand and liquidity:

- Adoption and User Base: Research the cryptocurrency’s adoption rate and user base. A growing community of users suggests increasing demand and potential for wider acceptance.

- Trading Volume and Liquidity: Check reputable exchanges’ trading volume and liquidity. Higher trading volume and liquidity indicate a more active market, making buying and selling the coin quickly easier.

- Profitable Conversion: High liquidity enables you to easily convert the mined coins into other assets or currencies, enhancing the profitability of your mining efforts.

Selecting a cryptocurrency with substantial market demand and liquidity sets the stage for a potentially profitable mining experience.

5. Block Rewards and Difficulty

Comparing the block rewards and difficulty levels of potential coins is crucial for estimating potential profits. Block rewards are the incentives miners receive for validating and adding transactions to the blockchain. Balancing the reward-to-difficulty ratio ensures that your mining efforts are both rewarding and sustainable. A coin with excessively high difficulty levels may reduce mining rewards, impacting your profitability.

Consider the following when evaluating block rewards and difficulty:

- Block Rewards: Block rewards are incentives earned by miners for validating transactions. Research the block rewards for the cryptocurrency you’re considering to understand the potential earnings.

- Difficulty Levels: Evaluate the difficulty levels of mining for each coin. A balanced reward-to-difficulty ratio ensures that your mining efforts are both financially rewarding and sustainable over time.

- Impact on Profitability: Be cautious of coins with excessively high difficulty levels, as they may lead to reduced mining rewards and lower overall profitability.

You can make informed decisions that maximize your mining gains by carefully analyzing block rewards and difficulty.

6. Energy Efficiency

The energy consumption associated with mining is an environmental concern that directly affects profitability. Consider the energy efficiency of the cryptocurrency you’re considering. Prioritize coins that offer better energy efficiency and contribute to higher profitability while minimizing your ecological footprint.

Prioritize energy-efficient coins by considering the following:

- Environmental Impact: Understand the energy consumption associated with mining the cryptocurrency. Opt for coins that demonstrate better energy efficiency to minimize your ecological footprint.

- Higher Profitability: Energy-efficient coins increase profitability by reducing electricity costs and maximizing mining efficiency.

Choosing energy-efficient cryptocurrencies aligns your mining efforts with sustainable practices and financial gains.

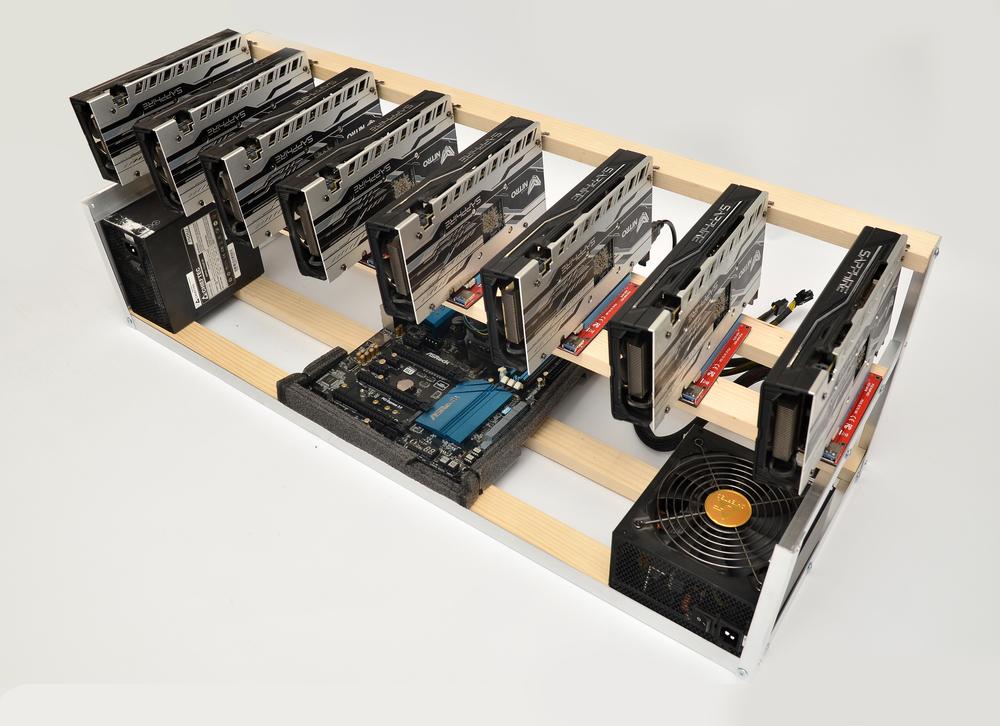

7. Mining Equipment Compatibility

Ensure your mining hardware is compatible with the algorithm used by the coin. Starting with basic equipment? Avoid coins that require specialized hardware. Compatibility ensures a seamless mining experience and prevents unnecessary expenses on equipment upgrades.

Consider the following points:

- Algorithm Requirements: Verify that your mining hardware aligns with the algorithm used by the coin. Using incompatible hardware can lead to inefficiencies and reduced mining rewards.

- Basic Equipment: If you’re starting with basic mining equipment, avoid coins that require specialized hardware. Focus on coins that can be efficiently mined with your existing setup.

Selecting coins compatible with your equipment ensures efficient mining operations without unnecessary hardware investments.

8. Development Team and Community

Research the development team behind the cryptocurrency project. Their experience, expertise, and track record reflect the potential for successful project execution. Engage with the community to gauge their support and engagement. A vibrant and active community contributes to the coin’s growth and adoption.

Evaluate these aspects carefully:

- Development Team: Research the experience and track record of the development team behind the cryptocurrency project. A skilled and experienced team increases the likelihood of successful project execution.

- Community Engagement: Engage with the cryptocurrency’s community to gauge their level of support and involvement. A vibrant and active community indicates strong community-driven growth and adoption.

Considering both the development team’s expertise and the community’s engagement can provide valuable insights into a coin’s potential for success.

9. Regulatory Considerations

Understanding the legal and regulatory status of mining a chosen coin in your jurisdiction is crucial. Avoid coins that may face uncertain legal challenges. Complying with regulations ensures a smooth and hassle-free mining journey.

Keep the following in mind:

- Legal Compliance: Research and understand the regulations surrounding cryptocurrency mining in your jurisdiction. Compliance ensures a smooth and lawful mining journey.

- Uncertain Legal Challenges: Avoid coins that may face uncertain legal challenges or regulatory issues, as they could lead to complications in the future.

Prioritizing regulatory compliance safeguards your mining activities from legal complexities and ensures a hassle-free experience.