In the dynamic world of cryptocurrencies, Bitcoin and Dynex have emerged as two prominent players. Bitcoin, the original cryptocurrency, has set the stage for digital currency evolution, while Dynex, a relatively new entrant, seeks to revolutionize the crypto landscape with its focus on anonymity, scalability, and neuromorphic computing. This article aims to provide a comprehensive comparison of these two minable coins.

| Cryptocurrency | Bitcoin | Dynex |

|---|---|---|

| Consensus mechanism | Proof of Work (SHA-256) | Memory-hard Proof of Work |

| Anonymity | Pseudonymous (public keys used for addresses) | Ring signatures and one-time keys for anonymity |

| Scalability | 1MB blocksize limit. Off-chain solutions needed. | Aims for better scalability through storage fees and authenticated state for light clients. |

| Emission schedule | 50 BTC block reward, halving every 210,000 blocks | Smooth emission to 100M coins according to formula |

| Purpose | Electronic cash system | Platform for neuromorphic computing |

| Innovations | First decentralized cryptocurrency and blockchain | Novel proof of work, anonymity features, focus on neuromorphic computing |

Overview of Bitcoin

Bitcoin’s Genesis

Bitcoin, a groundbreaking digital currency, made its debut in 2009 under the enigmatic pseudonym Satoshi Nakamoto. This innovative creation was driven by the vision of establishing a decentralized digital cash system that would challenge and redefine traditional financial structures.

Key Technical Features

Proof of Work (PoW) Consensus

At the heart of Bitcoin’s security is the robust Proof of Work (PoW) consensus mechanism. This mechanism employs the SHA-256 PoW algorithm, which forms the foundation of the network’s security. Miners dedicate their computational power to solving complex mathematical puzzles, thereby validating transactions and adding them to the blockchain. This process not only ensures the integrity of the network but also introduces new Bitcoins into circulation.

Block Rewards and Halving

Bitcoin’s economic model is characterized by block rewards and halving events. Miners are incentivized to secure the network by receiving new Bitcoins as rewards for their efforts. However, Bitcoin has implemented a unique feature known as “halving,” which occurs approximately every four years. During a halving event, the number of newly created Bitcoins awarded to miners is cut in half. This mechanism not only controls inflation but also plays a role in Bitcoin’s scarcity, as it gradually reduces the rate at which new coins are introduced.

Scalability Challenges

Bitcoin’s journey has not been without its share of challenges, particularly concerning scalability. As the network’s popularity grew, it encountered difficulties in handling a high volume of transactions within reasonable timeframes. This was partly due to the limited block size, which affected the network’s capacity. The scalability debate within the Bitcoin community led to various proposed solutions, such as the implementation of Segregated Witness (SegWit) and the exploration of off-chain solutions like the Lightning Network.

Pseudonymity Model

Transactions within the Bitcoin network are conducted under a pseudonymous model. While transactions are recorded on the public ledger known as the blockchain, they are not directly linked to real-world identities. Instead, participants in the network are represented by cryptographic addresses. This pseudonymous nature provides a degree of privacy but also opens the door to transaction traceability and analysis, a feature that has been the subject of both praise and criticism.

Bitcoin’s genesis and its key technical features have laid the foundation for the cryptocurrency landscape we see today. Its decentralized ethos, combined with the PoW consensus, block rewards, and pseudonymity model, have made it a trailblazer in the world of digital currencies. However, the ongoing challenge of scalability and the evolving crypto ecosystem have spurred further innovation and competition, including the emergence of cryptocurrencies like Dynex.

Overview of Dynex

The Vision Behind Dynex

Introduced to the cryptocurrency arena in 2017, Dynex embarked on a mission that transcends the realm of digital cash. Its vision is to extend far beyond Bitcoin’s scope and become a platform that propels neuromorphic computing to the forefront of technology. In this pursuit, Dynex seeks to address the limitations of Bitcoin while introducing groundbreaking innovations.

Key Technical Features

Memory-Hard Proof of Work

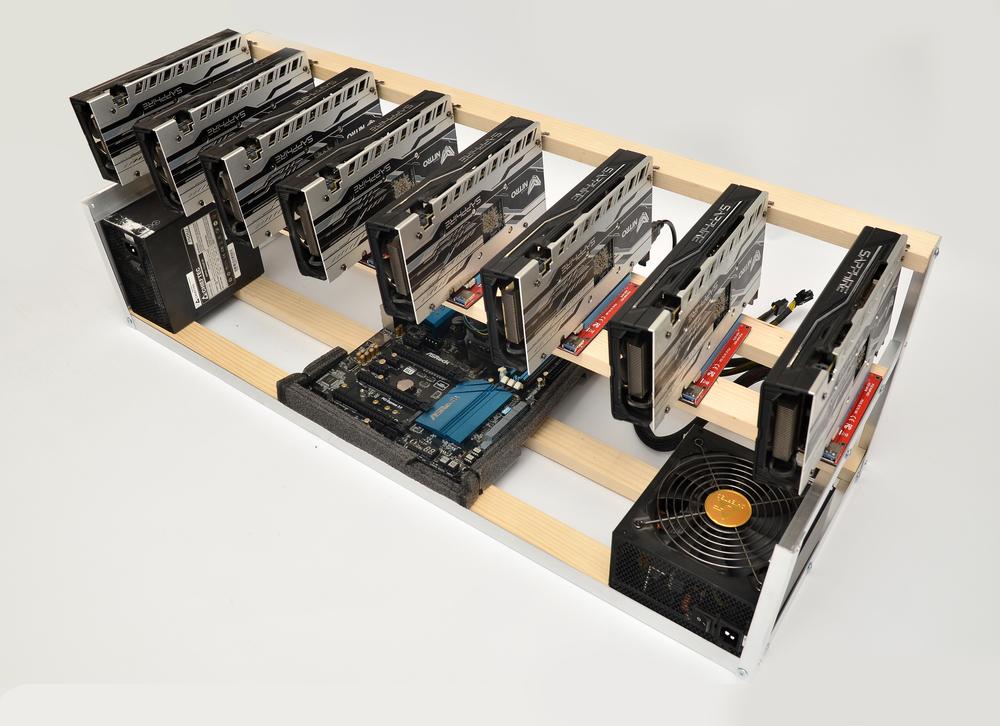

Dynex stands apart with its utilization of a pioneering memory-hard Proof of Work (PoW) algorithm. This innovative approach levels the playing field for miners, discouraging the dominance of specialized mining equipment. It ensures that mining remains accessible to a broader community, fostering decentralization and fairness.

Smooth Emission Schedule

Unlike Bitcoin’s halving events, Dynex has adopted a smooth emission schedule. This approach maintains a consistent coin distribution over time, eliminating the sudden reductions in block rewards characteristic of Bitcoin’s halving. This design choice enhances predictability and may contribute to a more stable ecosystem.

Anonymity Features

Dynex prioritizes user privacy through the incorporation of advanced anonymity features. Notably, it employs ring signatures, a cryptographic technique that enhances user privacy and anonymity. This feature distinguishes Dynex from Bitcoin, where transactions are pseudonymous and potentially traceable.

Scalability Solutions

Scalability has been a recurring challenge in the cryptocurrency space, and Dynex addresses this issue by exploring storage fees as a potential solution. This innovative approach aims to alleviate the congestion and high transaction costs that can plague blockchain networks during periods of high demand.

Neuromorphic Computing

Dynex’s primary and ambitious goal is to serve as a catalyst for neuromorphic computing. This sets it apart from Bitcoin’s focus on serving as a decentralized digital cash system. By emphasizing neuromorphic computing, Dynex seeks to revolutionize the computing landscape, ushering in an era of advanced machine learning and artificial intelligence.

Direct Comparison

Consensus Mechanisms

While Bitcoin relies on the traditional Proof of Work (PoW) mechanism, Dynex introduces a memory-hard PoW. This choice not only enhances mining accessibility but also promotes energy efficiency, aligning with contemporary concerns about the ecological impact of cryptocurrency mining.

Emission Schedules

Dynex’s smooth emission schedule diverges from Bitcoin’s halving mechanism. Instead of diminishing coin rewards over time, Dynex maintains a stable coin supply distribution. This approach may contribute to a more balanced and predictable ecosystem.

Anonymity Tech

Dynex outpaces Bitcoin in terms of user privacy, thanks to its incorporation of ring signatures. These enhance anonymity, in contrast to Bitcoin’s pseudonymous transactions.

Scalability Approaches

While both Bitcoin and Dynex recognize the importance of scalability, Dynex’s exploration of storage fees as a scalability solution sets it apart. This innovative approach may address congestion issues and enhance network efficiency.

Overall Vision and Purpose

Bitcoin strives to be a decentralized digital cash system, whereas Dynex envisions itself as a pioneering force in the field of neuromorphic computing. This overarching vision differentiates Dynex from Bitcoin’s primary focus on digital currency.

The key differences are:

- Dynex uses an improved proof of work designed to be more egalitarian and prevent ASIC dominance.

- It has anonymity features like ring signatures and one-time keys baked in.

- It is designed as a platform for neuromorphic computing, not just a cash system.

- The emission schedule and fees are tweaked to improve scalability and long-term viability.

In general, Dynex builds on the Bitcoin model with improved technology and a broader purpose beyond just a digital cash system. Its innovations are mostly around solving issues like mining centralization, scalability, and anonymity that Bitcoin has faced over time.

Innovations and Improvements of Dynex

More Egalitarian Proof of Work

Dynex’s commitment to a memory-hard PoW promotes a more equitable mining environment, resisting the concentration of mining power and specialized hardware.

Baked-In Anonymity Features

Dynex’s integration of ring signatures as an inherent privacy feature is a noteworthy innovation, providing users with enhanced privacy options absent from Bitcoin’s core design.

Scalability Improvements

Dynex’s exploration of storage fees offers a potential remedy to scalability challenges, addressing concerns about network congestion and high transaction costs.

Purpose as a Platform

Dynex’s distinctive focus on enabling neuromorphic computing distinguishes it from Bitcoin’s role as a digital cash system. This ambitious goal positions Dynex as a multifaceted platform with a broader scope.

Dynex’s innovative approach, marked by its memory-hard PoW, advanced anonymity features, scalability solutions, and emphasis on neuromorphic computing, represents a significant departure from Bitcoin’s foundational principles. As the cryptocurrency landscape continues to evolve, Dynex’s unique contributions and vision hold the potential to redefine the industry’s future.

Summary and Conclusions

In summary, Bitcoin and Dynex represent two distinct approaches to cryptocurrency. Bitcoin, as the pioneer, laid the foundation for the crypto world but grapples with scalability and anonymity. Dynex, on the other hand, brings innovations like memory-hard PoW, enhanced anonymity, and a focus on neuromorphic computing.

The future of these cryptocurrencies remains uncertain, but their coexistence in the crypto ecosystem reflects the diverse needs and aspirations of the crypto community. As technology continues to evolve, both Bitcoin and Dynex will play crucial roles in shaping the digital financial landscape.

6 FAQs: Demystifying Bitcoin & Dynex

The answer depends on your investment strategy and priorities. Bitcoin is considered a more secure store of value, while Dynex is efficient for everyday transactions.

Bitcoin is widely recognized and accepted, while Dynex may have limited acceptance depending on the platform or vendor.

Bitcoin was originally created as a decentralized electronic cash system, designed to facilitate peer-to-peer transactions without the need for intermediaries like banks.

Dynex seeks to become a platform that facilitates the development and application of neuromorphic computing, a new computing paradigm inspired by the human brain.

Both Bitcoin and Dynex have official websites and whitepapers containing detailed information. Additionally, numerous online resources and community forums provide diverse perspectives and analysis.

Additional notes:

- Bitcoin is the oldest and most well-known cryptocurrency. It is also the most valuable cryptocurrency, with a market capitalization of over $400 billion.

- Dynex is a newer cryptocurrency that was launched in 2021. It is designed to be more efficient and scalable than Bitcoin.

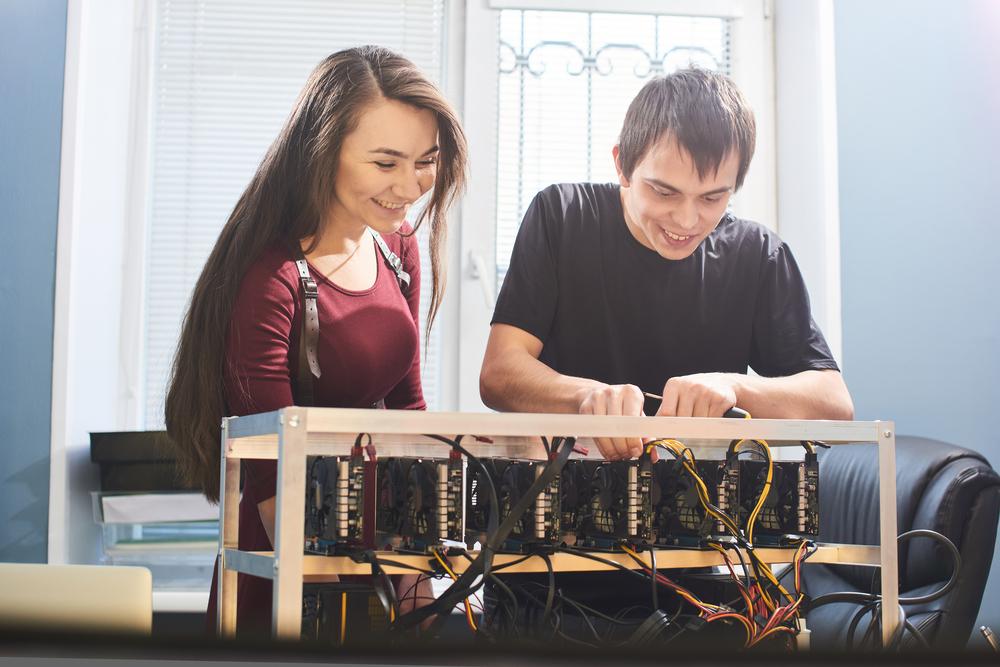

- Both Bitcoin and Dynex are minable cryptocurrencies, which means that new coins can be earned by solving complex mathematical puzzles.

- Bitcoin’s whitepaper was published in 2008, while Dynex’s whitepaper was published in 2021.

Conclusion:

Bitcoin and Dynex are both minable cryptocurrencies with different features and goals. Bitcoin is the older and more established cryptocurrency, while Dynex is a newer cryptocurrency that is designed to be more efficient and scalable. Ultimately, the best cryptocurrency for you will depend on your individual needs and preferences.